Personal Finance - My Investment Options for FY2023-24

In this blog post, I am sharing all my investment options across different goals for FY2023-24. I have written a similar blog post for FY2022-23.

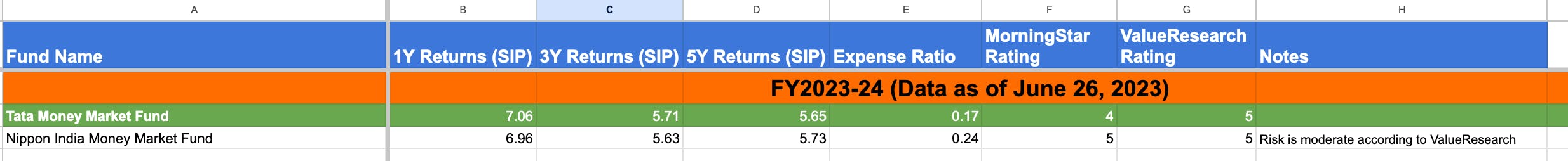

Emergency Fund

In FY2022-23, I invested in liquid funds for an emergency fund, despite they have given the instant redemption feature the returns are very low. So, for this year, I want to go for money market funds because they are offering good returns and I don't want an instant redemption feature.

I have shortlisted only two funds. Even though nippon has 5-star ratings from both agencies, the risk is moderate according to ValueResearch. So, I went ahead with Tata Money Market Fund.

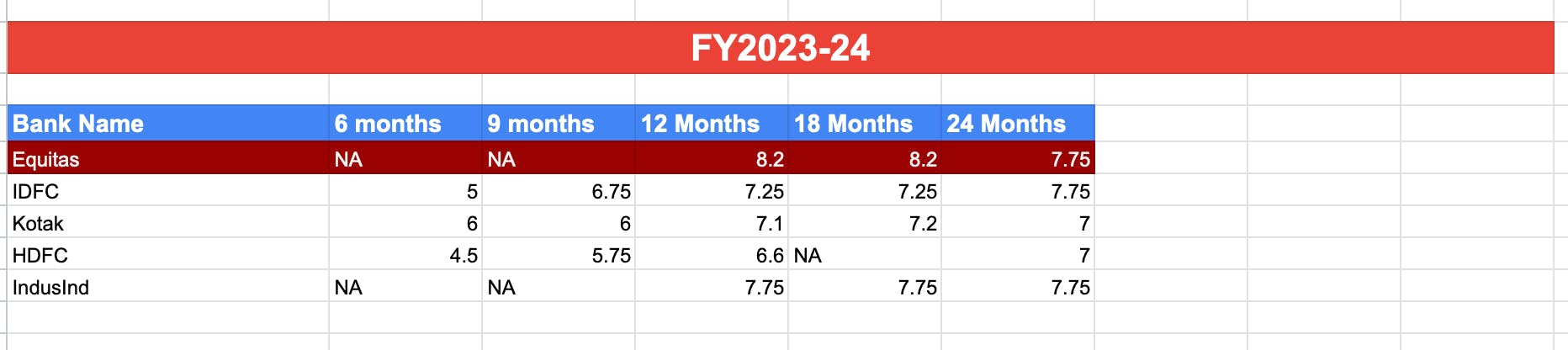

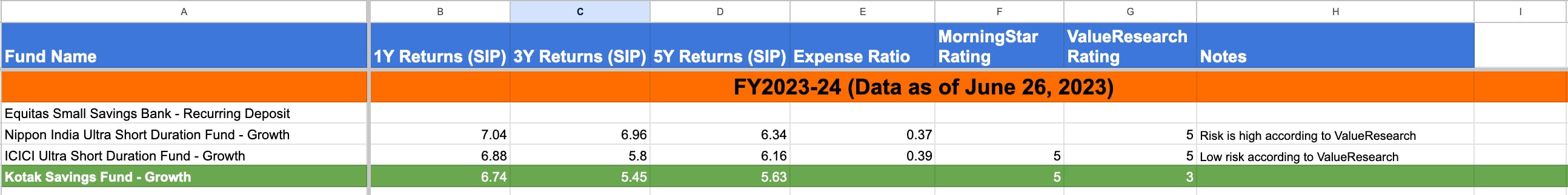

Short Term Goals

For short-term goals (1-3 years), I decided to use recurring deposits than debt mutual funds because, from this financial year, the government has removed the indexation benefit for debt mutual funds which means that they are taxed as income under the same tax slab. So, there is no difference between RD and debt mutual funds. I did some research and found that Equitas is giving a whooping 8.2% interest for RDs. When it comes to security, the DICGC insures principal and interest up to a maximum amount of five lakhs. So, not to worry about it.

For other short-term goals like vacation, I selected Kotak Savings Fund because it is rated 5 stars by morning star and NiyoMoney also recommends it.

Long Term Goals

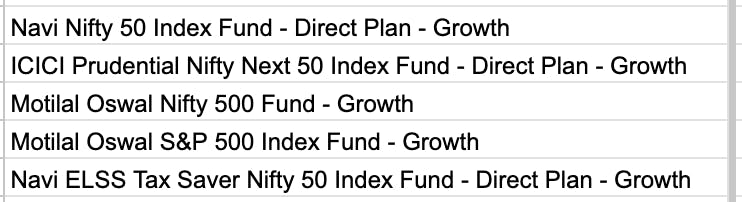

For long-term goals, I have been investing in index funds for the past 2 years for so many good reasons. So, for this year too, I will be going ahead with NiyoMoney recommendations.

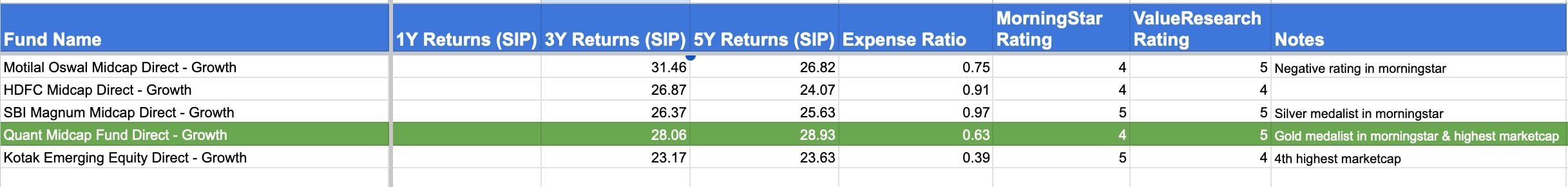

Apart from the index funds, I also started investing in equity active funds last year. So, I am continuing with the same funds but wanted to add a midcap fund to the portfolio. Hence, I selected Quant Midcap Fund. Even though Motilal Oswal is giving good returns, there is a negative rating in Morningstar.

Tax Saving Goals

The tax saving goals are the same as FY2022-23. Health Insurance, NPS, 80C.