Personal Finance - My Investment Options for FY2022-23

In this blog post, I am sharing the mutual funds I selected for the investment across different goals for FY2022-23.

Short-Term Goals (1-3 Years)

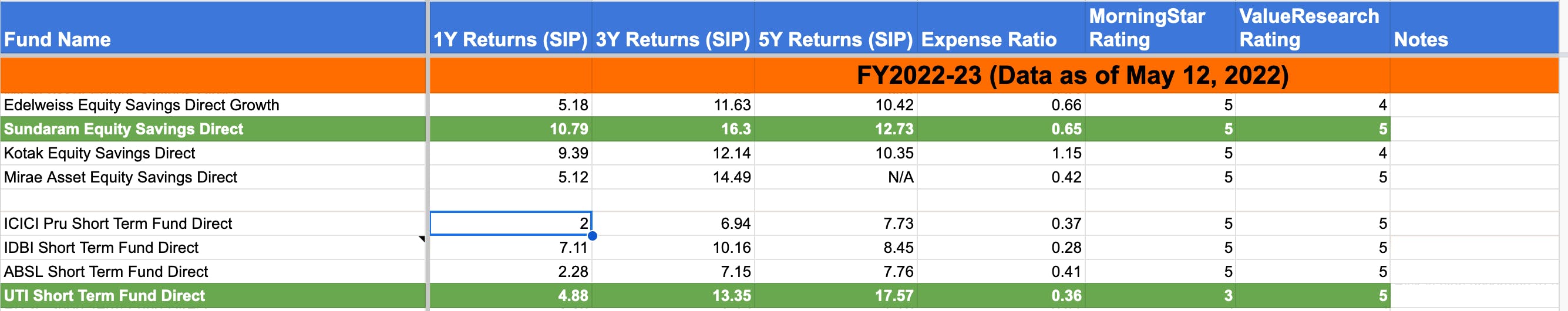

For short-term goals, the general recommendations are to select debt mutual funds, FD, RD. I prepared an Excel sheet of mutual funds and their returns. For the short-term goals which range from 1-3 years, I chose Sundaram Equity Savings Direct - Growth since it is performing well in the same category, the expense ratio is less and the ratings are good. Also, the reason why I chose the hybrid mutual fund category is that they invest 65% of the money into equity and equity arbitrage and 35% into debt so that the returns would be fair. I also had prepared for the moderate risk and determined not to touch it for at least 2 years.

In the category of short-term debt funds, I selected UTI short-term mutual fund mainly because the historical returns are very good even though the ratings are not good. Also, be careful with any debt funds except the money-market and liquid funds. They come with some volatility meaning their NAV changes frequently depending on many factors.

Emergency Fund

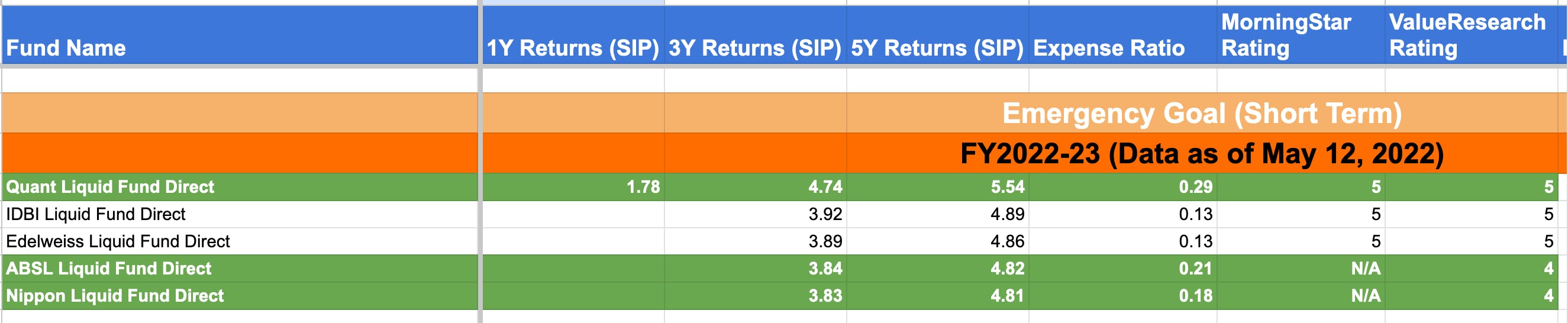

For emergency funds, it is a no-brainer to go with liquid funds. So, I selected the below 3 for it. Out of these, ABSL Liquid Fund and Nippon Liquid Fund are recommended by NiyoMoney because they provide an instant redemption option, so I kept them as is but added Quant Liquid fund for its historical performance.

Long Term Goals

For long-term goals which are greater than 5 years, I simply had chosen the index funds. One reason is in the long run, index funds give good returns over any other active funds. They also have a very low expense ratio. Also, there is no headache of rebalancing, taxes computation, etc... NiyoMoney had recommended the same, so I simply went with them.

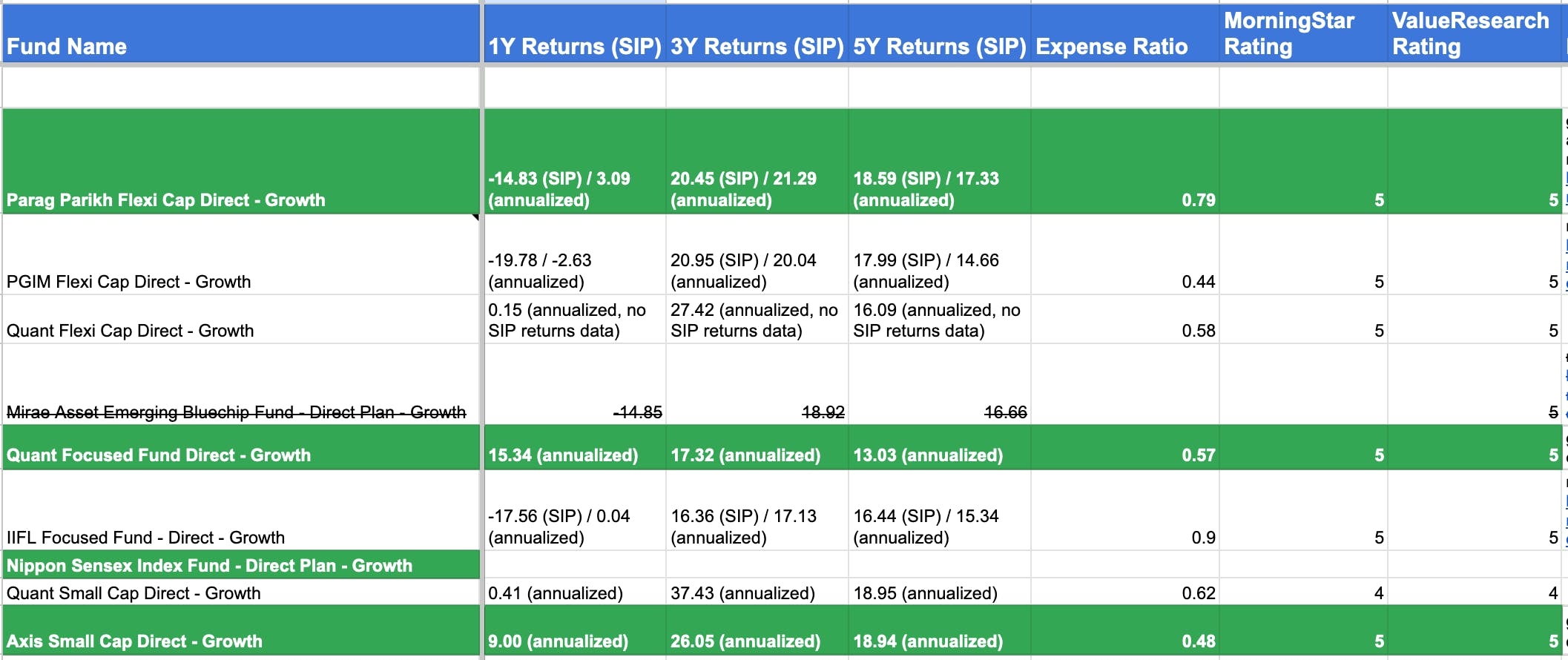

Apart from index funds, I wanted to invest in some of the active funds so that my portfolio will be diversified. For this, I selected flexi-cap, small-cap, contra, and focused fund categories.

I selected Parag Parikh Flexi Cap Direct-Growth, Quant Focused Fund Direct-Growth, Nippon Sensex Index Fund Direct-Growth, and Axis Small Cap Direct-Growth. The reasons would be rating by agencies, expense ratio, and historical returns.

Tax Saving Goals

Health Insurance

Under Section 80D, we can get deductions of 50,000 for the health insurance of parents and self-family. I bought HDFC ergo optima secure health insurance for 50,000 and claimed it as an income tax deduction.

NPS

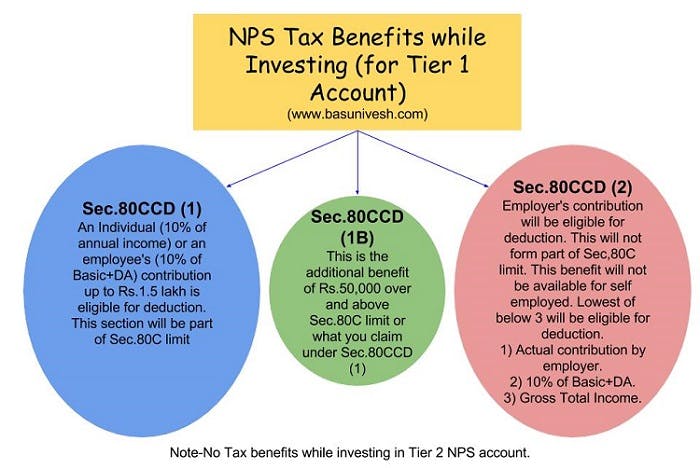

Very few people know that over and above the 80C limit of 1,50,000 we can get more exemptions. Under 80CCD(1B), the employee contributions to NPS are exempted up to Rs. 50,000 per year. Also under 80CCD(2), the employer contributions (up to 10% of basic pay) are exempted over and above. So, I opted for both to get more tax savings.

Term Insurance, ELSS mutual funds, SSY

I have taken term insurance which I pay 2700 per month and I invest 4000 every month in ELSS mutual funds. I also invest in SSY for my daughter 6000 every month. All of this constitutes 1,50,000 which is the 80C limit. We also have EPF contributions by the employer that comes under 80C.