I started my career in 2015. I have tried several ways to track my expenses. I have invested in multiple investment options. In this blog post, I want to share the learnings of my personal finance journey so far.

Tracking Expenses

In 2015, I used walnut (now axios) app to track my expenses. I used to track every penny using the app. From net banking, credit card, debit card, and cash transactions, everything I used to track. At that time, I didn't think about investments much and didn't concerned about my data privacy either. Most of us don't realize the impact of giving an app permission to read all the SMS'es and transactional data. It has its pros and cons. One of the pros is that very few good fintech companies that are compliant with government regulations use the data to analyze financial behavior and give better loan offers. But the con is that the data we are giving them is permanent, they can use it for a very long time and may share it with other companies too.

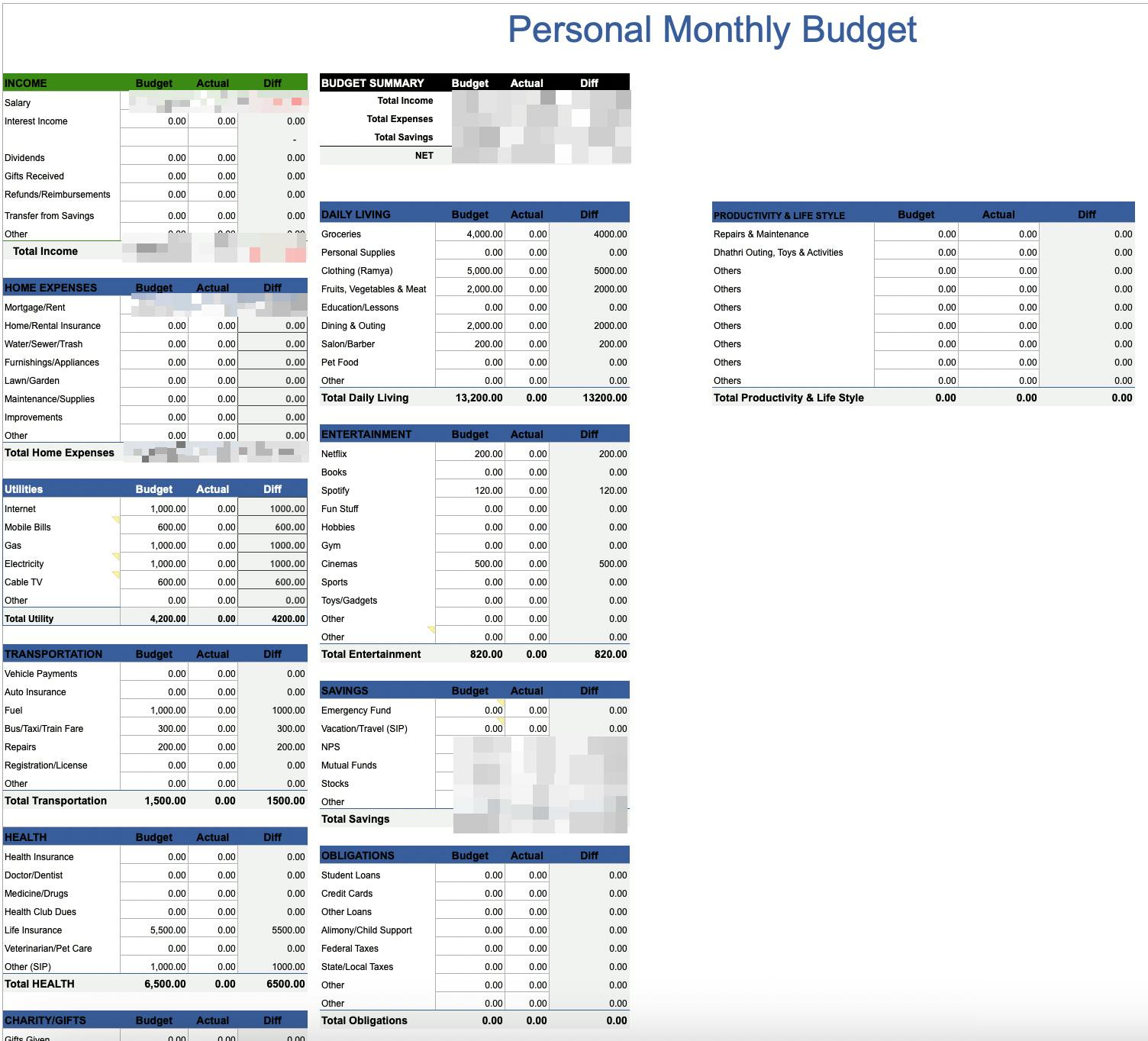

Later, in 2020, I created a spreadsheet to enter the data in a summary format, to get a clear picture. Later, I realized that I should have exported the data from Walnut and put it in the spreadsheet 🤦♂️ because the world runs on excel.

Later in 2021, I improved the template to a better version. But, still, the manual process of entering from Walnut into the spreadsheet exists.

Later in 2022, I stopped using Walnut, since I moved to iPhone. I started downloading the bank statements, introspecting them, and entering them into the report. Until October 2022, I used to micro-manage the expenses a lot. I used to enter a single rupee into the reports to know the cash-in and cash-out flows. But, I moved to a macro-management approach of tracking only major expenses and budgeting my salary into expenses and investments by keeping them in separate bank accounts. So, when I budget X as living expenses, I kept them in a separate bank account, spend them from it, and look at how much is remaining at the month's end.

The approach of macro-management and budgeting worked for me. It reduced my time to manage my finances and also gave the control over it.

Here's the budget template I use - https://docs.google.com/spreadsheets/d/107jTWsyzDal5dUOaaP8rXidnaolxMn0WzVgKuCIYzME/edit

Investments

In 2015, I initially started my investment journey with chit funds. I didn't have much control over the finances. My uncle asked me to invest in a chit fund and he rotated that money for interest. I faced a lot of month-end crunches due to it. I had to depend on credit cards, loans from friends, etc... At once, I had over-utilized my credit card limit and took a personal loan to clear it.

In 2018, I again invested in chit funds without knowing how they work. In 2020, I researched them and realized that people who organize chit-funds are the ones who make a lot of money. There is a very high risk involved in it even though they are private limited companies. Also, another problem is it is very hard to redeem them. When I call for redemption in an auction, I was asked to submit a blank cheque or property documents as a guarantee for it.

In 2021, I moved away from chit funds and started investing in mutual funds for the long-term and short-term. I used goalwise (now niyomoney) for all mutual fund investments. I followed their recommendations for my investments. I also invest in stocks via zerodha and used smallcase for the recommendations and rebalances. I also invest a good amount of money in physical gold every year. I write a separate post about how I select mutual funds.

Financial Discipline

Invest first, Spend later culture - To inculcate financial discipline, it took a lot of time and so many hurdles for me. I always tried hard to save and invest 75-80% of my salary by keeping some money in the emergency fund and keeping a buffer. I tried to live with minimal expenses, so they are not even 20% of my salary. I divide my investments into emergency, short-term, long-term, and tax-saving. Then, I find the investment options and put them.